In the growing Forex and financial sector, the "IB Affiliate Program" combines trading and affiliate marketing, allowing individuals and businesses to earn commissions by referring new clients to brokers. Central to this process is the use of reliable affiliate software like Tracknow, which helps brokers manage referrals efficiently.

Why the Forex and Financial Industry Needs Affiliate Software

Forex brokers and IBs require affiliate software to efficiently manage their affiliate programs and ensure they are scaling successfully. Without the right tools, brokers risk losing out on revenue, mismanaging affiliate payments, or dealing with inefficient tracking methods that could lead to inaccurate compensation.

Forex affiliate software is the cornerstone of a successful affiliate marketing strategy in this industry, offering the following benefits:

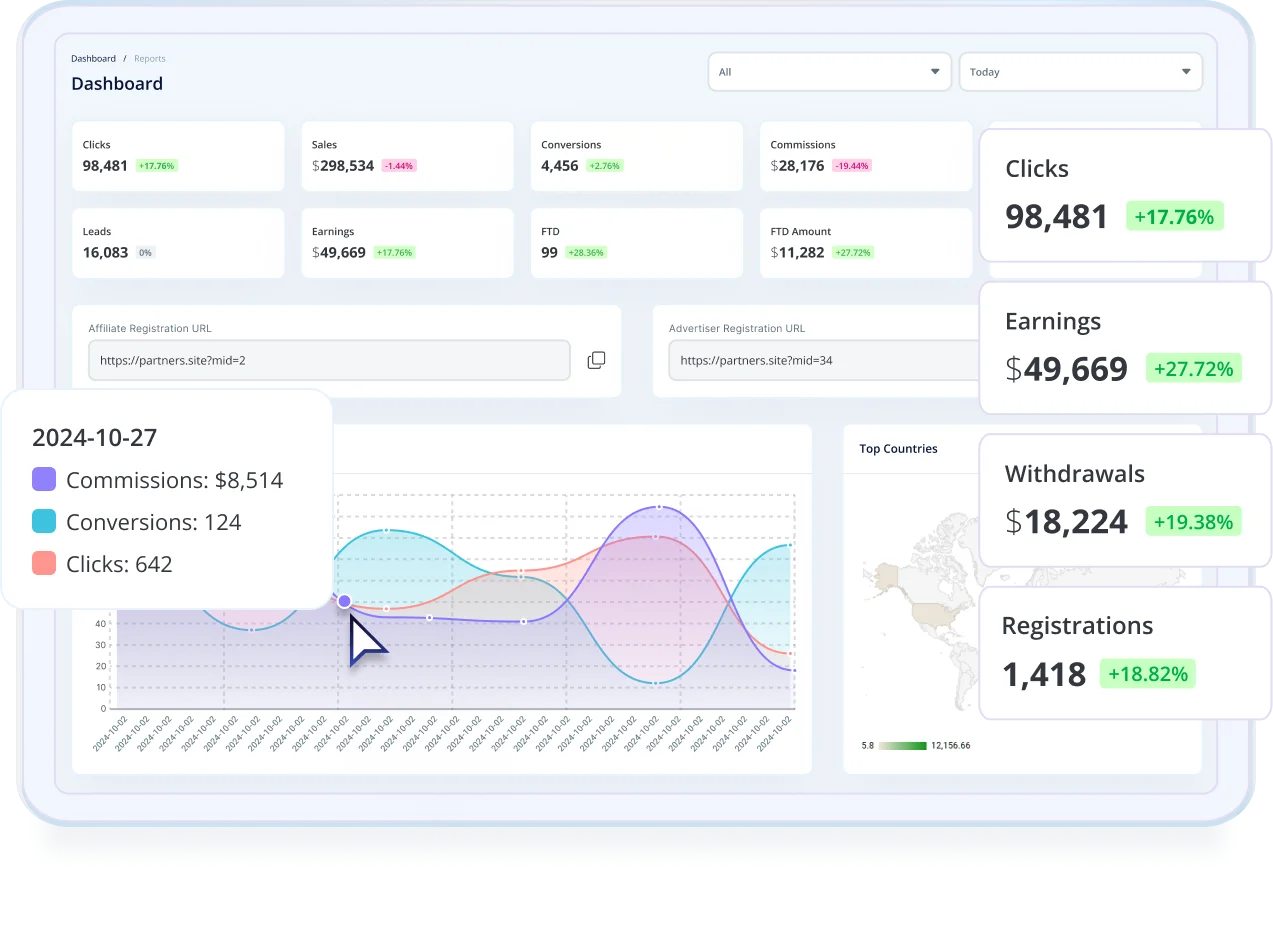

- Streamlined Operations: Affiliate software automates various tasks, from tracking conversions to calculating commissions, reducing the manual workload for brokers and affiliates.

- Better Control: Brokers have full control over the affiliate program, from setting up custom commission plans to monitoring affiliate performance.

- Improved Transparency: Affiliates have access to clear reports on their referrals, commissions, and performance, increasing trust in the program.

Understanding Forex IB (Introducing Broker) and CPA Models

A Forex IB, or Introducing Broker, is an individual or organization that refers new clients to Forex brokers. In exchange, the IB receives a commission, typically based on the trading volume or activity of the referred clients. This model is a perfect fit for Forex affiliate software, as it simplifies the tracking and management of referrals and commissions.

Another popular model in Forex affiliate programs is CPA (Cost Per Acquisition). In this model, affiliates are compensated when the referred client makes a deposit or executes a certain number of trades. The CPA model is known for its simplicity and direct approach, offering quick payouts to affiliates.

Criteria for Selecting Affiliate Software for the IB & CPA Industry

When choosing affiliate software for the IB and CPA industry, brokers should look for the following features:

-

Comprehensive Reporting: Software should provide detailed insights into traffic, referrals, and commissions across various compensation models.

-

Seamless Integration: The software should integrate easily with the broker's trading platform and CRM system to ensure a smooth workflow.

-

Scalability: As Forex affiliate programs grow, the software must be able to handle increasing volumes of affiliates and transactions without losing performance.

-

Real-time Analytics: Brokers need to track the performance of their affiliates in real time to make data-driven decisions and optimize their programs effectively.

-

Automation: Automated tracking, reporting, and payouts help reduce administrative burdens and ensure that affiliates are paid on time. Ready integrations with automated payment systems for affiliates, such as Tipalti, provide a significant advantage by simplifying the payout process and further streamlining operations, making it easier to manage global payments and ensuring seamless, accurate transactions.

-

Customizable Commission Structures: Affiliate software should allow brokers to easily manage multiple commission models, from IB affiliate tracking to CPA plans tracking.

-

Security: Strong security features are essential to protect sensitive financial and affiliate data.

Maximizing Earnings with RevShare, Pip, and Spread Rev Share

Among the various compensation models available, RevShare stands out as one of the most lucrative. It involves affiliates earning a percentage of the revenue generated by the referred traders. This model is attractive because it offers ongoing income potential based on the activity of the traders over time.

Pip RevShare and Spread Rev Share go one step further, where affiliates earn a share of the pips or spreads generated by their referred clients. These methods are highly regarded for their transparency and their direct correlation with the trading activity of clients.

Conclusion

The Forex IB Affiliate Program represents a significant opportunity for those looking to capitalize on the lucrative Forex market. With the right approach and the use of sophisticated tools like Tracknow's IB & CPA Affiliate Tracking Software, affiliates can navigate various compensation models like CPA, RevShare, Pip and Spread Rev Share with ease. Whether dealing with ROW or standard accounts, the potential for growth and earnings in this arena is substantial, especially for those who partner with the best brokers and leverage top-tier affiliate software.

Glossary of Key Terms

- IB (Introducing Broker): An individual or entity that introduces clients to Forex brokers in exchange for a commission.

- CPA (Cost Per Acquisition): A commission model where affiliates are paid for each referred client who meets specific criteria, such as making a deposit or executing trades.

- RevShare (Revenue Share): A commission model where affiliates earn a percentage of the broker's revenue generated by their referred clients.

- Pip RevShare: A type of RevShare where affiliates earn a share of the pips generated by their referred clients.

- Spread RevShare: A variant of RevShare where affiliates earn a share of the spread revenue generated by referred clients.

- Conversion Tracking: The process of monitoring when a referred client completes an action that triggers an affiliate's commission, such as making a trade or deposit.

- Affiliate Software: Software that helps manage affiliate programs by tracking referrals, conversions, and commissions.

For more information on Forex IB affiliate programs, explore Tracknow’s comprehensive tools that help brokers optimize their affiliate strategies with ease.

FAQ

1. What is an Introducing Broker (IB) in Forex?

An Introducing Broker (IB) in Forex is an individual or company that refers new traders to a Forex broker. In exchange, the IB receives a commission based on the trading activity of the clients they refer. This model is commonly used in Forex affiliate programs and is ideal for individuals or companies looking to earn commissions by promoting Forex services.

2. How do CPA and RevShare models differ in Forex affiliate programs?

The CPA (Cost Per Acquisition) model compensates affiliates when a referred client makes a deposit or executes a certain number of trades. It’s typically a one-time payment. On the other hand, RevShare (Revenue Share) offers ongoing commissions based on the revenue generated by the referred client, making it a more sustainable model for long-term earnings. Pip RevShare and Spread RevShare are specific variants where affiliates earn a share of the pips or spreads generated by their clients.

3. Why do Forex brokers need affiliate software?

Forex brokers need affiliate software to efficiently manage their affiliate programs. The software simplifies the tracking of referrals, conversions, and commissions, ensures accurate and timely payments, and provides real-time analytics. It also helps brokers handle multiple compensation models, such as CPA and RevShare, while optimizing affiliate performance.

4. What are the key features to look for in Forex affiliate software?

Forex affiliate software should provide real-time reporting and analytics to track affiliate performance. It should allow for customizable commission structures to accommodate different models like CPA and RevShare. Additionally, the software must integrate seamlessly with existing platforms, automate commission payouts, and ensure high security.

5. How does Tracknow help Forex brokers manage their affiliate programs?

Tracknow provides comprehensive affiliate software that helps brokers manage and optimize their affiliate programs. It offers advanced features for tracking IB & CPA conversions, allowing brokers to efficiently monitor affiliate performance and streamline commission payouts. With Tracknow, brokers gain control, transparency, and powerful tools for growing their affiliate programs.

6. What is the optimal payment commission model for maximizing earnings in Forex affiliate marketing?

The most common comission models for maximizing forex affiliate earnings are RevShare (Revenue Share), CPA (Cost Per Acquisition), and hybrid models (CPA + RevShare). Each offers unique advantages depending on your goals.

In the Forex industry, there are also other models such as Pip RevShare and Spread RevShare, which allow affiliates to earn on each pip or spread generated by their referred clients. These models are transparent and closely tied to trading activity, making them especially lucrative when working with active traders.

The optimal model depends on your strategy. If you're aiming for long-term earnings, RevShare and hybrid models are the best choices. For a quick start and immediate payouts, CPA could be a better option.