In the ever-evolving world of forex and crypto trading, affiliate marketing has become an indispensable tool for growth. For fintech brokers, success hinges on precision, adaptability, and innovative technology. Tracknow Affiliate Software emerges as a game-changing solution, delivering powerful features tailored specifically to the fintech industry. This article explores how Tracknow helps brokers optimize affiliate strategies to stay competitive in global markets.

Affiliate marketing has become an essential strategy in the fintech industry, bridging the gap between innovative financial solutions and a broader audience. With its performance-based approach, affiliate marketing offers fintech companies an efficient and cost-effective way to grow their user base and increase brand awareness.

The fintech sector thrives on trust, transparency, and convenience. Affiliate marketing aligns perfectly with these values by leveraging partnerships with trusted affiliates, such as finance bloggers, influencers, and niche content platforms. These affiliates promote fintech products like payment gateways, investment platforms, lending solutions, and budgeting apps through authentic and engaging content. This personalized approach not only enhances user trust but also drives qualified leads, making affiliate marketing highly effective in this industry.

One of the key advantages of affiliate marketing in fintech is its measurable results. By tracking user actions—such as clicks, sign-ups, and transactions—fintech companies can gauge the performance of their affiliate campaigns in real time. This data-driven model allows for strategic adjustments, ensuring optimal return on investment (ROI). Additionally, the pay-per-performance structure minimizes risks, as businesses only pay for results.

Another benefit is scalability. Fintech companies can tap into global markets by partnering with affiliates who have an established presence in different regions. This approach is especially valuable for fintech startups seeking rapid growth without the significant upfront costs associated with traditional advertising.

However, success in affiliate marketing requires a well-designed strategy. Fintech companies must carefully select affiliates that align with their brand values and target audience. Clear communication, competitive commissions, and robust tracking software are essential to maintaining successful partnerships.

The fintech industry demands targeted affiliate solutions due to its unique regulatory, security, and market challenges. Standard affiliate platforms often fall short in managing complex commission structures like IB (Introducing Broker) models or CPA hybrids, which are essential for forex and crypto trading. To meet these needs, high-quality affiliate tools must offer real-time tracking, advanced fraud prevention, and strict compliance with regulations such as GDPR or CCPA. Equally important is adaptability for global markets, including multilingual and multicurrency support, to effectively serve international brokers and affiliates.

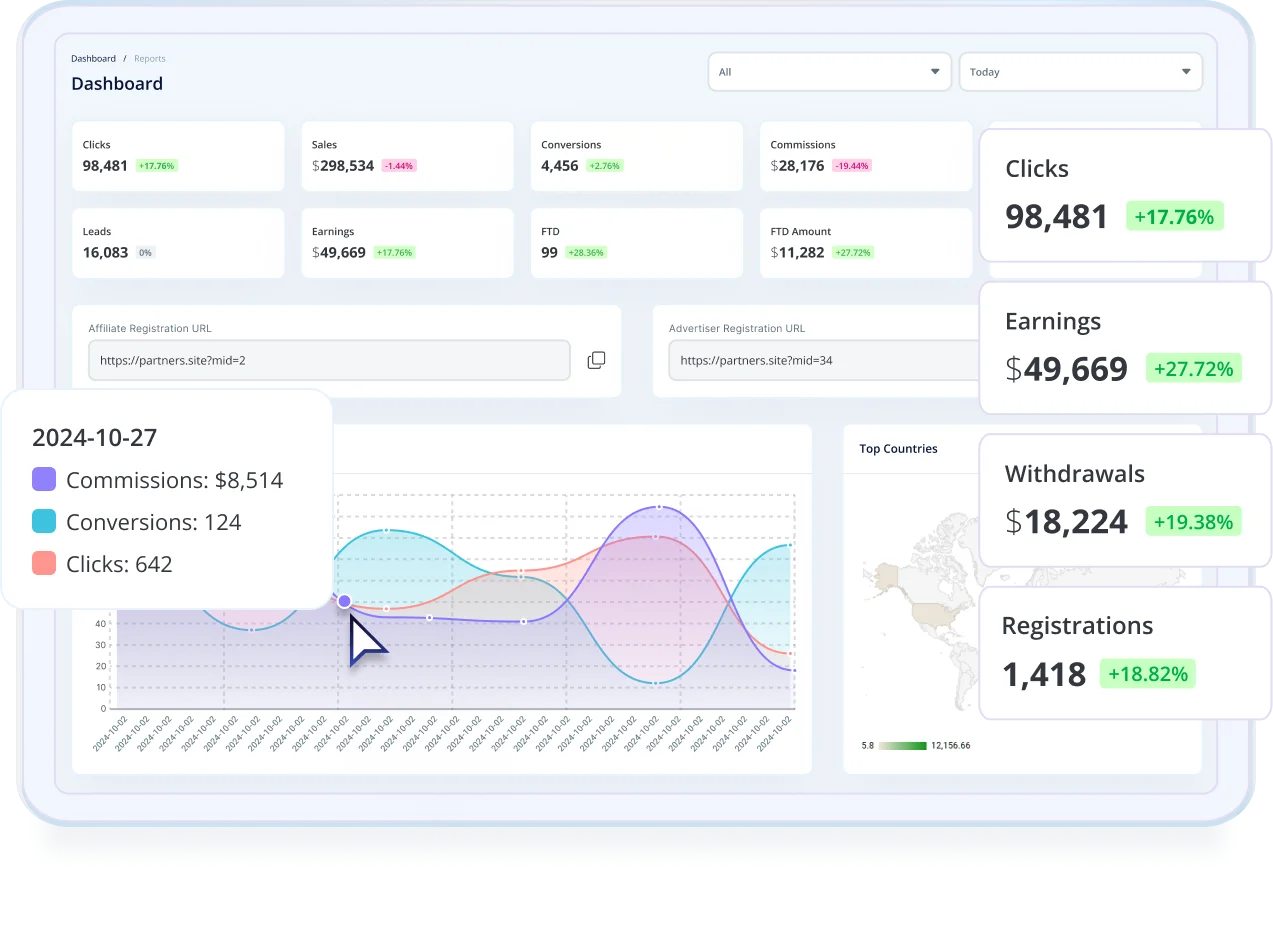

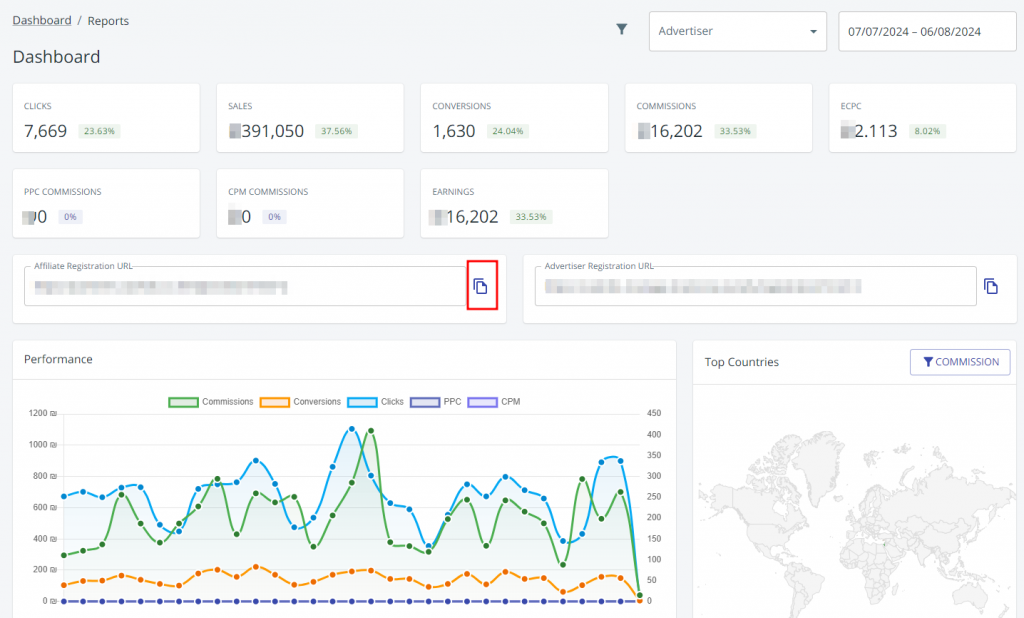

A streamlined and user-friendly interface is essential for managing complex affiliate operations in fintech. Tracknow’s dashboard is designed for fintech professionals, offering an intuitive experience that simplifies the management of campaigns, affiliate data, and financial reports. Even brokers new to affiliate marketing can quickly navigate its features and harness its full potential.

Efficient data visualization for real-time decision-making.

Customizable views for different roles (e.g., managers, affiliates).

Seamless integration with analytics tools for enhanced insights.

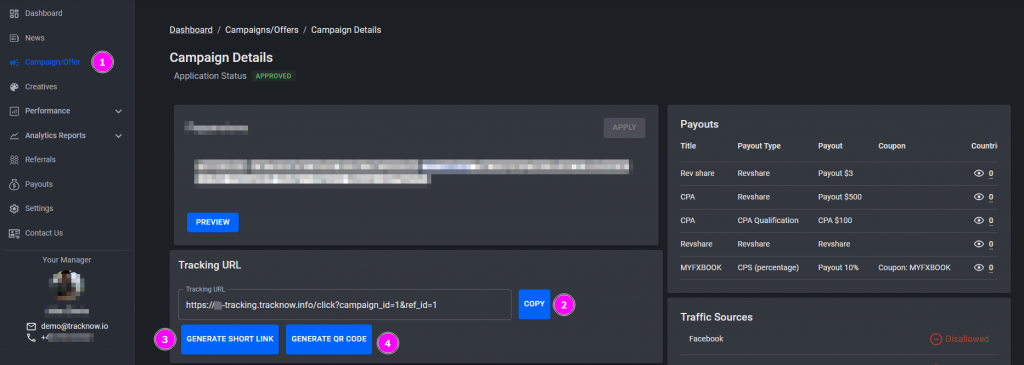

In fintech, accurate tracking is critical for transparency and trust. Tracknow’s real-time referral tracking and coupon code system deliver unmatched accuracy, allowing brokers to measure and optimize performance with confidence. The advanced referral tracking ensures every affiliate activity is accounted for, while the unique coupon code system enables easy tracking of non-digital leads, such as in-person events or offline campaigns.

Granular data on clicks, conversions, and commissions.

Real-time updates to track fast-paced forex and crypto markets.

Flexibility to manage complex multi-channel campaigns.

Advantages:

Mixed models to incentivize performance.

Geotargeted campaigns aligned with market regulations.

Clear, automated commission calculations.

If you want to learn more about these and other commission-based models, please read our article, "Affiliate Program Commission Options".

Global fintech markets are diverse, and one-size-fits-all solutions don’t work. Tracknow’s customization options empower brokers to create country-specific affiliate strategies that resonate with local trends. The platform enables brokers to localize campaigns with tailored commission models, ensuring relevance and regulatory compliance in key markets like Europe, Asia, and the Middle East.

Localization of campaign materials.

Support for multilingual and multicurrency operations.

Compliance with international data protection regulations (e.g., GDPR).

Security is a cornerstone of fintech operations, and Tracknow takes this responsibility seriously. With robust encryption, fraud detection, and regulatory compliance features, brokers can trust Tracknow to safeguard sensitive data. The platform employs cutting-edge encryption and AI-driven fraud detection, ensuring every transaction and affiliate interaction is secure.

Built-in fraud prevention mechanisms.

GDPR, CCPA, and other compliance frameworks.

Redundant servers for consistent uptime.

For fintech brokers, the need for an affiliate management tool that balances innovation, flexibility, and security is paramount. Tracknow delivers all this and more, offering:

A user-friendly interface tailored to fintech professionals.

Advanced tracking tools for real-time accuracy.

Flexible commission models for diverse strategies.

Global adaptability for international campaigns.

Industry-leading security for peace of mind.

Concluding the article, we highlight Tracknow's position as a leader in the fintech affiliate marketing software sector. Its comprehensive features, including flexible commission models, real-time tracking, coupon code system, and customization options for international markets, make it an invaluable asset for brokers in forex and crypto trading. Tracknow stands as the epitome of innovation and efficiency in fintech affiliate marketing.

Ready to transform your fintech affiliate program?

Sign up with Tracknow today and experience the future of affiliate marketing tailored to the needs of forex and crypto brokers.

1. What is affiliate tracking software, and why is it important for fintech brokers?

Affiliate tracking software helps fintech brokers monitor and manage affiliate activities, ensuring transparency and efficiency. It tracks clicks, leads, and commissions in real time, making it easier to optimize marketing strategies and maximize ROI.

2. How does Tracknow ensure data security?

Tracknow prioritizes security with advanced encryption, AI-driven fraud detection, and compliance with international regulations like GDPR. This ensures all affiliate and broker data is safe and reliable.

3. Can Tracknow’s software handle international markets?

Yes, Tracknow is designed for global fintech markets. It offers multilingual support, multicurrency options, and tools to customize campaigns for specific countries, ensuring compliance with local regulations.

4. What commission models does Tracknow support?

Tracknow supports multiple commission models, including IB, CPA, CPM, and CPC. Brokers can also mix IB and CPA models by region, allowing for flexible and targeted affiliate strategies.

5. How customizable is Tracknow for unique business needs?

Tracknow provides extensive customization options, from tailored commission structures to localized campaign materials. The platform can adapt to any fintech broker’s unique business model, ensuring optimal performance.

6. Why are integrations with other services essential in affiliate tracking software?

Integrations simplify online business management by connecting affiliate software with CMS platforms & e-commerce solutions, payment systems, and marketing tools. Tracknow supports seamless integrations to streamline operations and improve efficiency.

7. How do I get started with Tracknow?

Getting started is simple. Sign up on our website and provide information about yourself and your business. After that, you can complete the initial setup by specifying your preferred parameters. The process is intuitive, and our support team is always available to assist if needed.